Top 7 Lead Generation Tips On How To Build A Highly Successful Marketing Plan For Advisors

If you’re looking to get inspired with your own marketing strategy, you’ve come to the right place. Before proceeding to the good stuff, I need to remind you to stay compliant. Verify with your compliant team for all marketing materials you produce and solicit business with.

Now that we got the boring stuff out of the way, let’s take a deep dive into the intricacies of building a highly successful marketing plan for advisors that is semi-automated once is chugging along.

These marketing secrets and tips can be useful for the following professionals: financial advisor, insurance advisor, accountants, consultants and service based entrepreneurs.

For the sake of this post, we’ll focus on showing you an example of a very profitable marketing plan for financial advisors. With that being said, the same tactics and principles can be applied to any other serviced based business.

1) Website And Search Engine Optimization For Financial Advisors

The fact of the matter is, every single day, there are several people looking for your services online in your area. Nowadays, you can earn business locally, nationally and internationally. You can even sign clients and close deals without ever meeting them face-to-face.

Question we need to ask ourselves is, how do we find our perfect avatar client/customer?

Where are they hanging out?

Is it possible that our “perfect client/customer” hangs out online and uses search engines like Google, Bing, Yahoo, etc.?

The answer is YES!

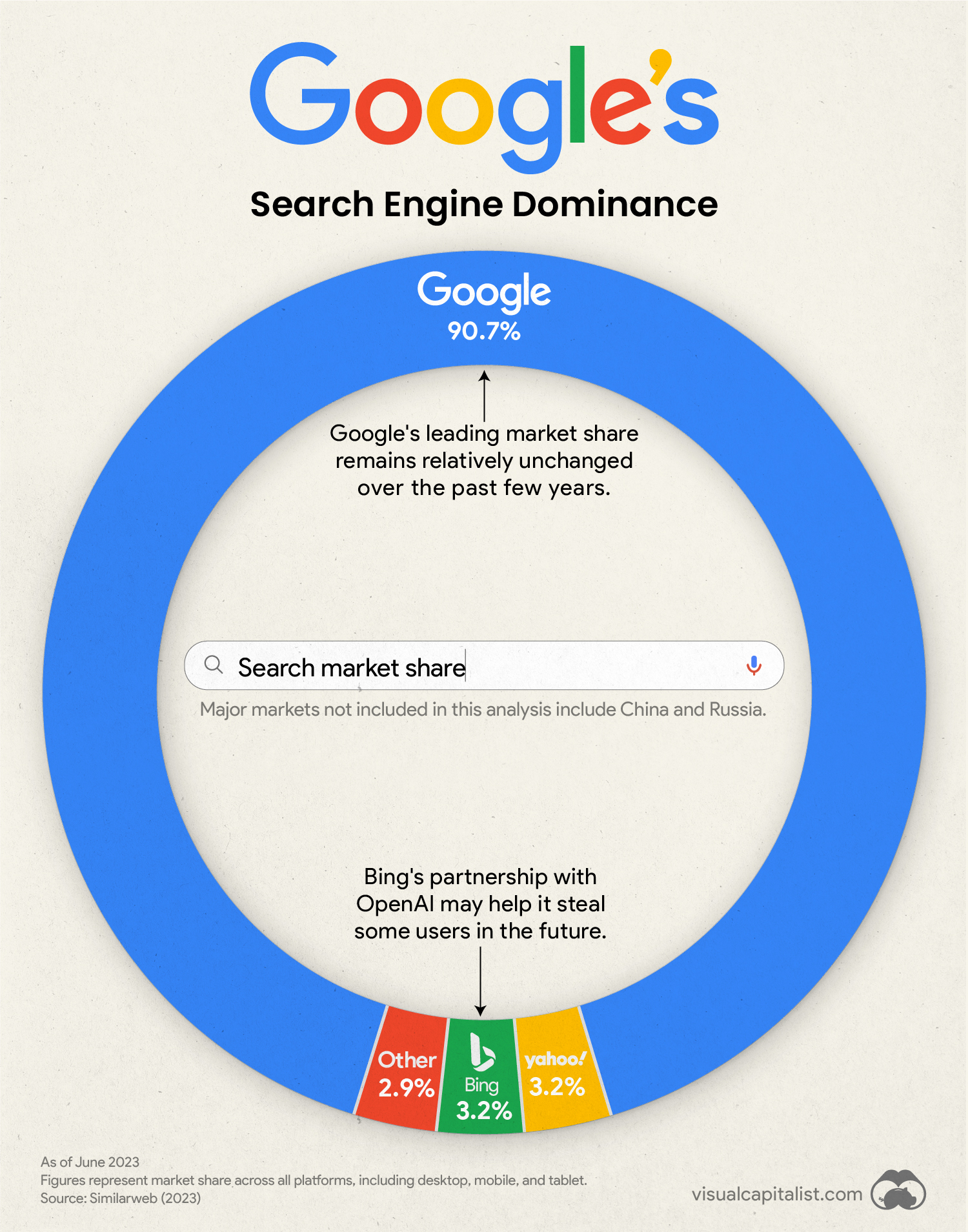

These days, everyone is online in some form or fashion. In addition, one thing is for certain, most folks use Google for any search queries, more than any other search engine by a landslide. See image below.

Chart above provided by visualcapitalist.com

Whether Google visitors want a solution to their problem, or a quick answer to their question, Google is the #1 trusted source online to give their users what they want.

ANSWERS and SOLUTIONS!

Ok, so now that we know this information, how does it help you as a financial advisor trying to market yourself online?

How To Optimize Your Website For Lead Generation

I recommend properly setting-up and optimizing your website for search engines like Google. You’ll give yourself better odds of ranking your website higher in the search engine results pages (SERPs) for specific keyword phrases related to your business.

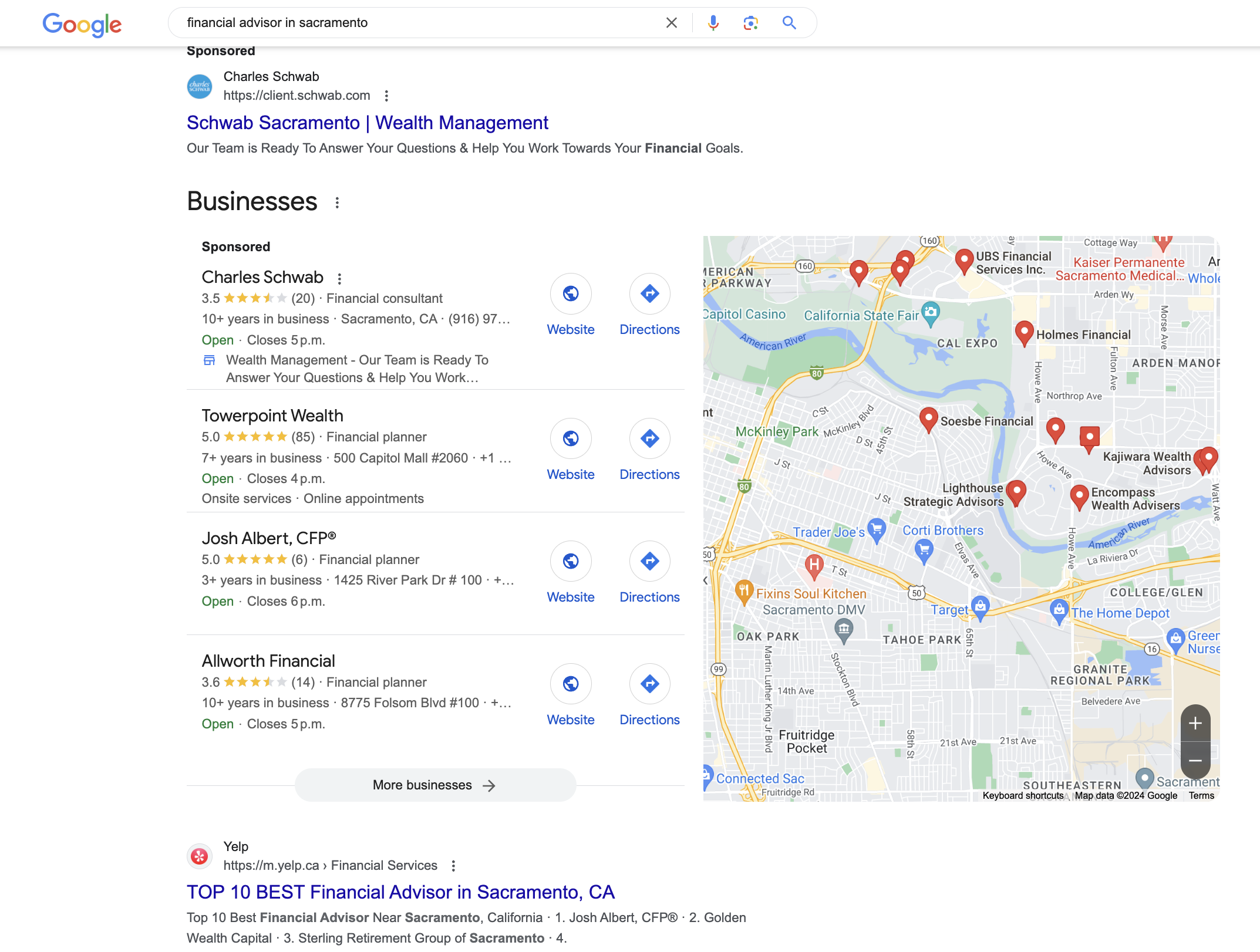

Let’s take a look at the image below.

You’ll notice at the very top there is a “Sponsored Ad” for Charles Schwab, and then a second “Sponsored” ad in the local pack map (Google Maps area).

Everything else underneath is organic, meaning it’s not a paid ad (not sponsored). Essentially, your website can rank organically in the LPM (local pack map) and in the organic listings below the LPM.

You can do so by simply investing your time and/or money in SEO, the art of making your website appear at the top of Google’s 1st page.

The long term benefits are well worth it!

Keyword Sentences For Financial Advisors’ Marketing Strategy

On any given day, people are typing in:

- “Financial Advisor near me”

- “Best Financial Advisor in [city]”

- “[city] Fee-only Financial Advisor”

- “Fiduciary Financial Advisor”

So on and so forth, I think you get the point.

Wouldn’t it be nice if your website could rank at the top of Google when someone types in one of those search queries above?

It’s a rhetorical question, OF COURSE it would be nice!

Website Optimization For Keywords

There are countless of keyword combinations you might want your website to rank for, because it will bring in a “warm visitor” to your website. This “warm visitor” is a potential client/customer who’s actively looking for a professional like you that provides your type of services.

It’s now your website’s “job”, to do the work of convincing this visitor that you are the person they are looking for. Strive to fully optimize the front end of your website to “sell” the visitor, a.k.a. potential prospect. Make sure it’s clean, organized and aligned with your brand (culture, colours, font, messaging, awards, testimonials, etc.)

How To Generate Leads For Financial Advisors On Google (organically, without paid ads)

First thing is first, you’ll need to create a website if you don’t already have one. Assuming you do, you’ll want to optimize it as much as possible for proper SEO (search engine optimization) and for UX (user experience). Both SEO and UX go hand in hand.

You want to make it as effortless as possible for website visitors to find what they are looking for. This could be anything from reading your educational content, comparing your prices/fess, reading your testimonials, to gathering your contact information.

The foundation of your website needs to be properly categorized and laid-out in order to make it effortless for your visitors and the Google bots to “crawl” your website.

This is how Google determines what kind of content is on your site. Additionally, it helps Google consider (through 200 ranking factors) whether it’s worthy of ranking higher in the SERPs, the search engine results pages.

There is some technical work that needs to be completed in the backend of a website to make it fully optimized.

Meta Tags, titles, site map and proper schema are some of the duties that a SEO professional or a business owner needs to address on their website. Doing so will increase their odds of snagging one of the top spots on Google for business related keyword phrases.

A web developer or SEO professional can usually assist you with these tasks if you don’t have any experience in web development.

Simply book a consultation call to chat further if that’s something you’re interested in doing for your business website.

Keyword Research Tips For Financial Advisors

Keyword Research usually comes first before implementing any changes on your website.

I personally use a fantastic tool called Mangools. It helps me curate a list of keyword phrases related to my business providing analytics on search volume, trends, keyword difficulty and much more.

We’re looking for highly searched keyword phrases with weaker competition. Those will be your low-hanging fruit keywords.

I recommend that you also curate a list of high ROI keywords. Integrate those low-hanging fruit and high-ROI keywords on your website and in your content (main website content and blog).

Once Google “crawls” your website, it will then determine what type of content is on your website and to whom it should serve it to in the SERPs.

There are several tricks of the trade that you should consider implementing when it comes to fully optimizing your website for search engines. Aim to simultaneously optimize for online conversions (sales, booked calls, submitted contact forms, etc.)

2) Website Optimization Tips For Financial Advisors

Here’s a few suggested ideas:

- Put your contact email and phone number visible at the header and footer of every web page.

- Include 2-3 Call-to-Action buttons on every page.

- Consider implementing an AI chat bot service to answer any inquiry a prospect might have on the spot.

- Include quality content of every service you offer with several of your keyword phrases (from your list).

- Build a Testimonials/Awards/Accolades web page to show your credibility in the niche. Display them accordingly across your website as well (Example: add your best testimonial on your contact/booking page).

- Write valuable content for your blog that you can repurpose on other platforms.

- Build an “About Us” page. People want to know who they’re dealing with.

- Make sure your meta tags include some of your high-ROI and low-hanging fruit keywords. This is the area that explains to Google and their visitors what your pages are about. Every page has it’s own Meta tag area.

- Create congruent business profiles on 3rd party websites (like Yelp, Yellow Pages, Social Media Platforms, etc.). This will bolster your link profile and your domain authority. Both are important for your SEO’s success. The more traffic coming to your website from authoritative sites, the better it is in Google’s eyes.

Google Business Profile For Financial Advisors

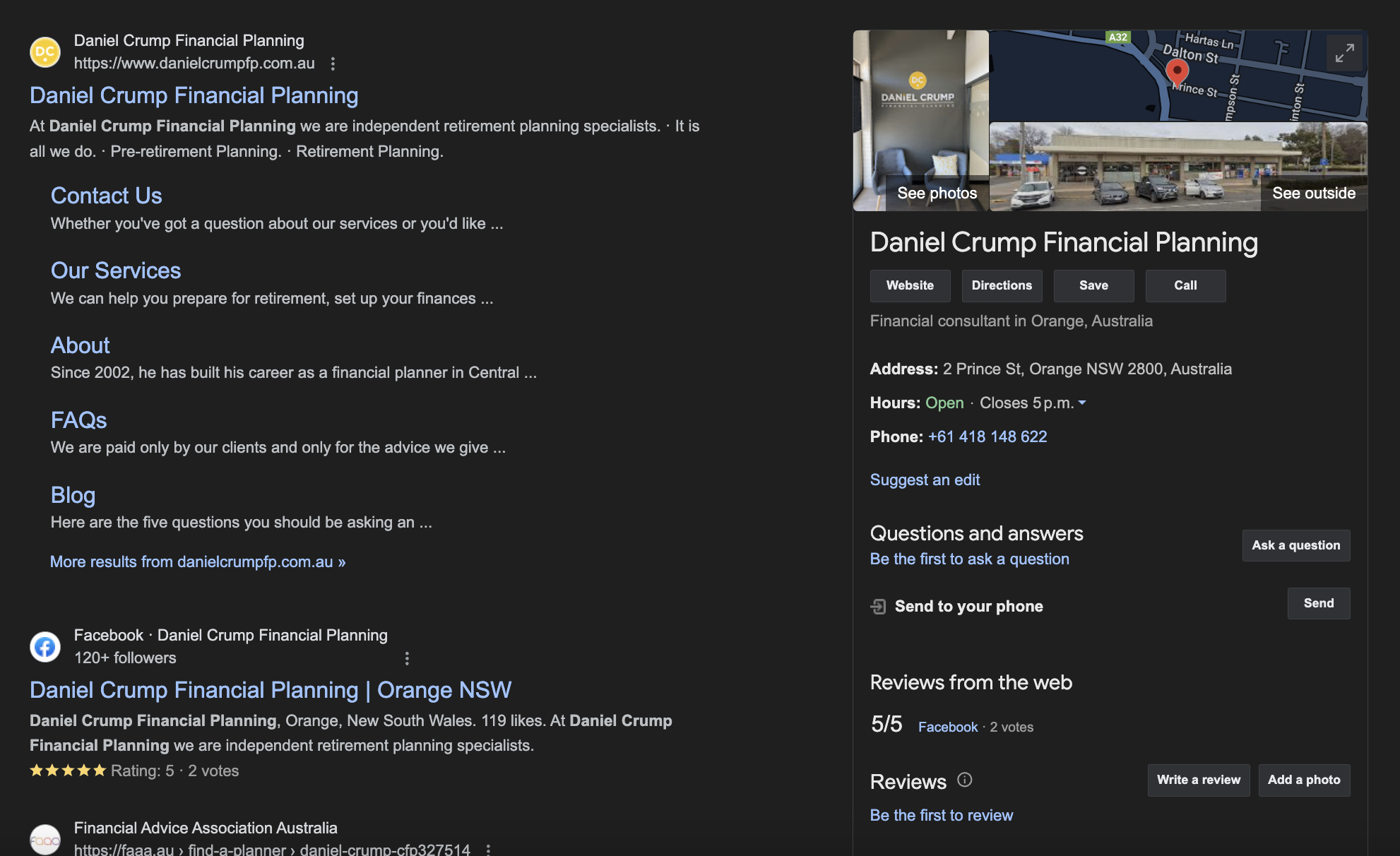

After you’ve optimized your website frontend and backend, consider completing your GBP (Google Business Profile). See the right section in the image below. It’s where your business name appears along with other information such as the business address, phone number, write a review link, etc.

To start, simply type in “complete my Google Business Profile” in Google, and follow the steps. Doing so will enable you to gather Google reviews and earn more visibility on Google.

Generally speaking, if you rub Google’s back, it’ll rub yours back. Google would prefer to work with legitimate and professional brands that they can recommend to their users (online searchers). If you complete all the recommended steps by Google to complete your GBP, your now way ahead of the game.

I believe it’s important to fully complete your GBP. Not many businesses are doing it, so it’s your gain if you take the couple of minutes to complete it.

You can also post “updates” on the platform to stay relevant in Google’s eyes. It’s good practice to be active and consistent on the “updates”. Whatever you can handle in your tight schedule. Alternatively, this could easily be delegated to someone on your staff.

You’ll need to verify your business with a code sent to you by mail from Google. Until it’s verified, you won’t be able to claim and have a GBP. Once your code is verified, go ahead and complete your GBP.

Why 5-Star Reviews Matter For Financial Advisor

Afterwards, feel free to send the “review link” to existing satisfied clients/customers to start earning 5-star reviews and to boost your website exposure by ranking up in the SERPs.

5-star reviews have a ripple effect and knock 2 birds with one stone. Not only do they help rank your website higher on Google, they also help “convince” people that you are credible and trustworthy.

Stars have forever been affiliated with success, victory and excellence! They hold a lot of psychological power when it comes to persuasion and influencing people’s decisions.

I highly recommend putting a lot of effort in garnering 5-star reviews. They give you the biggest bank for your buck, in my educated experience.

3) Search Engine Marketing – Search Engine Optimization + Paid Ads

When was the last time you remember going a full day without seeing/hearing advertisement?

Mine was when I went fishing in the wilderness on a weekend, but I digress. It doesn’t happen very often to say the least.

Most of us see dozens if not hundreds of ads if you combine all the ads from every device and platform, on any given day.

The practice of search engine marketing (SEM) is search engine optimization (SEO) combined paid advertising. Essentially, your business website can saturate the 1st page of Google with paid ads and good SEO.

If you play your cards right, your business can appear 3 times on the 1st page of Google for high ROI keyword sentences. The Sponsored Ads section, the Google Local Pack and the organic listings.

There’s a reason why there are so many businesses advertising.

It’s simply because proper marketing works. However, not all ads are built the same and you can certainly “traffic arbitrage” to get the most bang for your buck.

Comparing Ad Platforms For Financial Advisor Ads

Example: A 1000 impressions on Google for specific keywords related to your business may cost around $200-300, with analytics provided and the ability to retarget. This strategy will be a lot more effective versus a 1000 impressions in a neighbourhood digital magazine at the same cost but with no analytics/stats provided.

Not to mention the visitors of the digital magazine might not fit your ideal client/customer profile, whereas Google users type in search queries related to your business or practice. In this case, your money would be better spent with Google Advertising. Better bang for your buck!

How To Generate Leads For Financial Advisors With Google Ads

Google Ads are without a doubt the quickest way to get leads/prospects contacting you by phone, email or contact form. Beware though, as they are a double-edged sword if you are not careful. More on that further down below.

The great thing about Google Ads is that they mostly appear in the the highest valued digital real estate, a.k.a. the very top page of Google’s 1st page for high ROI keywords.

Regular text ads can appear at the very top and bottom of Google’s 1st page. The advertising model is an auction system. Essentially, you’re competing against other businesses for higher ad spots on the 1st page. This applies to all keywords and keyword sentences.

Google also offers video ads (YouTube), display ads, discovery ads, image ads, etc.

Negative Keywords For Financial Advisors

Updating your negative keywords list is an absolute must. This is a list of search terms within the Google Ads dashboard that you DO NOT want to target in the SERPs. Meaning, Google will NOT show your ad(s) when people type in search queries with one of your negative keywords included in the keyword sentence.

Example: You may want to include terms like “calculator” on your negative keywords list since many people type in “retirement calculator”.

You want to show up for people typing in queries with “retirement” in it, but might not want “calculator” in the keyword sentence since you DON’T offer a calculator on your website.

You’d be wasting dollars on clicks. Folks would likely bounce off your website right away since they can’t find the calculator.

Food for thought, there’s an opportunity here.

It might be wise to include a retirement calculator on your website if there’s a considerable amount of traffic that is searching this term. This could be a great top of the funnel asset for your business.

Other negative keywords you might want to include could be personal names or other business names in your niche.

When you’re investing in Google Ads, you’ll want to make sure your landing page on your website is optimized for the desired Call-to-Action.

Is it to book a call?

Perhaps to join your newsletter?

Is it to watch your Webinar?

You’ll want everything from the ad copy, the headlines, to the messaging on the landing page to be congruent with each other.

4) How To Build An Email List – Lead Generation Tips For Financial Advisors

The most important asset you can build for your online marketing strategy is your email/mobile list.

This is a list YOU own personally. Your subscribers and your followers on social media unfortunately belong to the platform itself.

If they decide to shut down one day, or your account gets hacked or banned for any reason, you’re hooped! All that hard work of building that following goes down the drain.

That’s why it’s super important for you to create a strategy to convert subscribers and followers into prospects/leads in your email/texting list.

This list is an asset you own forever. At a click of a few buttons, you can instantly reach hundreds, even thousands of people. That’s powerful for your marketing strategy!

How To Generate Pre-Qualified Leads For Financial Advisors

First off, you’ll want to brainstorm a couple of ideas for a FREE Lead Magnet. A lead magnet is a giveaway (product or valuable information). A tripwire is a low-cost product (physical or info) with the intention of selling the lead/prospect more expensive services later on.

I personally like giving away valuable information for FREE (like this blog article). The barrier to entry is significantly lower than selling information to strangers.

The double-edged sword with giving away FREE stuff is that you will get free-loaders taking advantage of your intellectual property, but that’s just the cost of doing good business in my opinion.

When you’re selling a tripwire, you aim at generating leads and potential clients that are not afraid of investing in themselves.

These leads are more likely to become your clients and invest in your high-ticket services since they already “trust” you enough to buy your tripwire.

If your lead magnet and tripwire deliver on their value to your leads and customers respectively, your higher ticket product/services are in a great position to sell themselves.

Lead Magnet Examples For Financial Advisors

Here are five simple valuable offers, a.k.a. lead magnets you could present to your audience in exchange for their contact information to build your email list.

- Webinar Masterclass on a specific topic (retirement planning, insurance planning, proper accounting, etc.)

- PDF Checklist/Template (Top 7 Ways To Earn More In Retirement)

- Niche Newsletter (covering industry news, sharing your latest thoughts on market trends, etc.)

- Free Consultation, second opinion on current situation

- The Ultimate Guide To XYZ

Now that you’ve decided what lead magnet you’re going to offer to your audience, it’s time to choose where you’ll advertise this lead magnet.

Try offering your lead magnet in the following areas:

- Your website, via a pop-up or static opt-in on most web pages.

- Ads that direct users to an opt-in page offering your lead magnet.

- On social media by providing a link in the post, comments/descriptions area or in your biography

- By mail (not my preferred method but still effective for some).

How To Generate Quality Leads For Financial Advisors And Avoid Unqualified Prospects

In order to mitigate or reduce “crappy leads” from coming in to your pipeline, you’ll want to be clear as possible in your messaging about who this lead magnet is for.

Think about what type of prospect you are trying to attract and convey this to your audience in your messaging across your website, ad copy, landing pages, etc.

Example: This investing masterclass webinar was designed specifically for business owners with over +100K in investable assets.

If you’re in or over that ballpark, you’re in the right place. This webinar is just for you.

If you’re not a business owner nor in that ballpark of investable assets, I recommend doing XYZ to accelerate your journey to financial freedom. This webinar might not be for you.

However, there’s a ton of valuable information for those trying to grow their portfolio. Stick around till the end because I’m saving the best for last.

In the above example, we’ve indicated that the webinar was created for BUSINESS OWNERS with 100K in INVESTABLE ASSETS. This pre-frames the audience in what to expect from your lead magnet. Odds are, you will attract more of your perfect client avatar and less junk leads.

Pre-framing your audience throughout the customer journey is highly recommended. Meaning, you should pre-frame your potential clients in your ads, your landing page, your lead magnet and your post opt-in email sequence.

5) Top Email Marketing Tips For Financial Advisors – Best Automated Email Newsletter Practices

Email marketing absolutely needs to be a part of your strategy. Emailing your prospect list gives you the opportunity to stay top of mind, show your knowledge on the matter, inform your audience of the latest news, offer promos, etc.

Text marketing is highly recommended as well and can be just as effective, if not more than email marketing since open rates are much higher on text messages versus emails.

With that being said, you’re somewhat limited in the length of your message in SMS format compared to an email. We’ll focus on email in this section of the post but the best practices can be applied to text messaging marketing.

Here are some questions you should consider when creating your email marketing strategy:

- Do I need to set-up an automated email sequence to drip my prospects once they’ve entered my pipeline via a lead magnet or contact form inquiry?

- How often should I send emails manually? (That are NOT part of the automated email sequence)

- What should I include in my emails?

- What software should I use to send my emails? (Is it compliance approved?)

- Can I leverage my email message to push traffic to another platform or channel of mine? (Example: push the audience to watch a YouTube video).

- How can I approve my email deliverability score to avoid hitting the junk/spam/promotion folder and land in the main inbox?

Email Automation Best Practices

Once a lead or prospect enters your email/text pipeline, you can automate communication to them by building an email sequence.

An email journey might differ from prospect to prospect depending on the actions they’ve taken in the emails that we’re sent to this said individual.

Let’s look at the image below as an example.

At the top left of the image, you see a question mark in the orange diamond shape icon. This indicates that we can push the individual to the next specific email we want them to receive based on the action(s) or lack thereof on the previous email.

Some actions include but are not limited to: opening the email, clicking on a specific link in the email, unsubscribe, etc.

How To Automate Your Email Marketing Sequence For Financial Advisor Leads

IF you want an email subscriber to receive email DEF (the subscriber’s 2nd email in the sequence) after they’ve opened email ABC (the 1st email in the sequence), you configure the email software to do so.

IF you want the email subscriber to receive email GHI instead (alternative 2nd email in the sequence) because they HAVEN’T opened the email ABC, can you set up the email flow to achieve this desired result.

Generally speaking, your first 3 emails in the sequence should be welcoming, and reminding the email subscribers to check out your lead magnet. That’s how you’ll build trust, credibility and authority.

The next 3 emails will be Call-To-Actions. It could be to submit a consultation form, call-in, email you to book a meeting, or book directly in your calendar system (my preferred CTA).

You can highlight the pain points of what they might be currently experiencing in their day-to-day life and offer them a solution to their problems.

I recommend presenting the benefits of what being a client looks like. In addition to showing them how to leverage the services you provide to maximize their desired result. Including higher portfolio returns, minimized taxes, well-crafted financial plan, peace of mind that the estate is well prepared and taken care of, etc.

The next +3 emails in the sequence will offer value to your email list. You can discuss and teach important topics while introducing subtle CTAs in your email. This might be of interest to those who wish to learn more about the topic, about you or about your services.

Feel free to share “personal stories”, testimonials and case studies in your emails. Some folks will relate to them, and this will give you better odds of converting them from a prospect to a client. They’re opportunities to humble brag about yourself, your accomplishments and your clients’ success stories.

Best Email Nurturing Tips – Lead Nurturing Examples

A newsletter is your typical, yet still very effective email nurturing tool.

Other nurturing examples:

- Social Media

- Live Events (Forums, Wine & Dines, Golf Events, Seminars)

- Media (Live, Online or Paper)

- Access to other webinar sessions

6) How To Create Profitable Financial Advisor Ads On Social Media

Social Media ads differ slightly from Google Ads. Ads on social platforms aim to interrupt the user scrolling through their feed.

A video/image including pattern interruption paired with a great hook in the ad copy has higher odds of capturing the users’ attention, which results in more opt-ins to your lead magnet offer.

Financial Advisor Lead Magnet – What’s Your Unique Value Proposition?

Firstly, you’ll have to determine what is your offer/lead magnet.

Once you’ve decided on your unique offering, you can now start collecting your image and video assets, crafting your ad copy & headlines, building your ad campaign (on your preferred social platform), and then optimizing your landing page (web page of your website or landing page software).

In my experience, Meta (Facebook/IG) and YouTube are the best social platforms for running ads to the wealth management and financial planning demographic. You can’t ignore LinkedIn and X (formerly Twitter) as plausible successful advertising platforms as well.

One thing to consider is that LinkedIn ads are substantially more expensive than its counter partners, but they do offer a much higher number of your target client avatars with higher net-worths.

Here’s a great place to check out what other businesses advertisers on Facebook are doing: https://www.facebook.com/ads/library/

Simply type in the Business Facebook Page of your competitor, and feel free to “spy” on their ads.

Get inspired by your competitors in the industry and analyze what kind of ads they’re running along with their landing pages.

Food for thought, the older the ad, the higher the odds are that this particular ad has been successful for them. If you can see it, t’s still live and running. Facebook library indicates if they’re currently LIVE, along with the published date.

Why else would they still keep an old ad on and published?

Unless, they’re terrible ad managers and the ad isn’t overly successful, you can assume it’s profitable and still converts if it’s still LIVE after all these months/years.

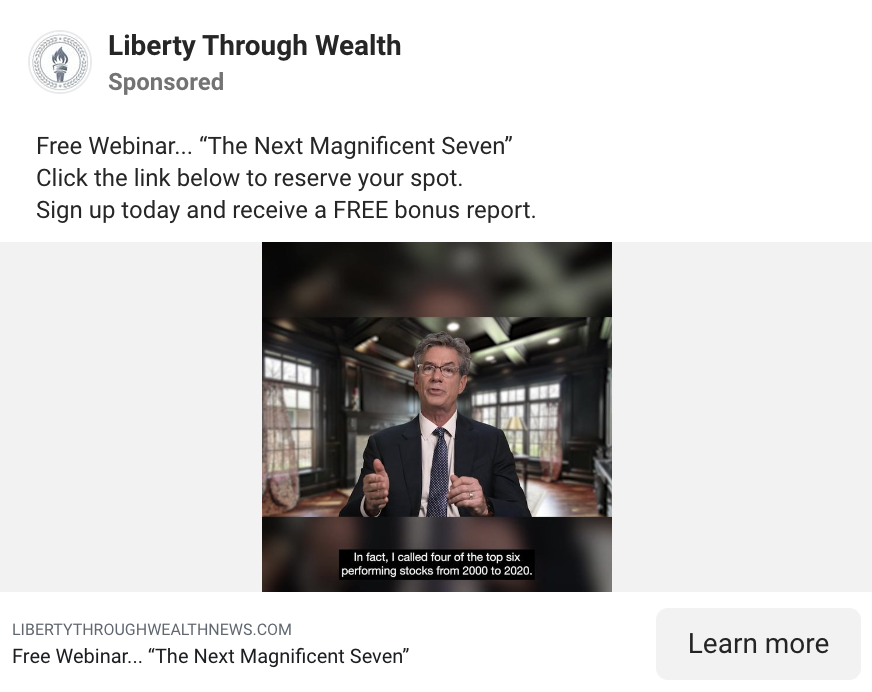

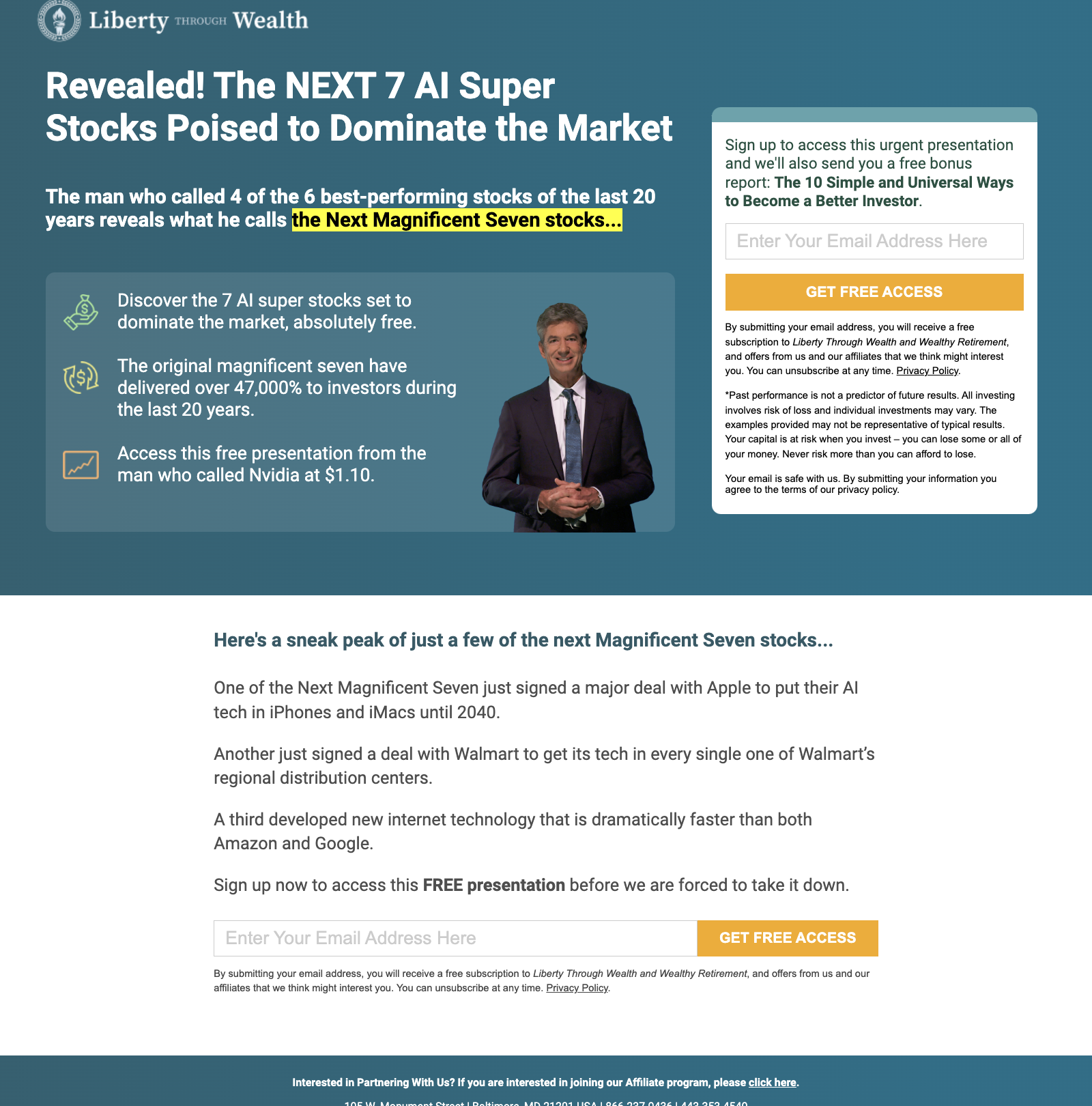

A Step-By-Step Example Of A Financial Advisor Ad Campaign

Here’s what the flow of a typical financial advisor ad campaign should look like:

- Ad creation on social platform of choice (select an Image/Video, Title, Headline, Text Area, Call-T0-Action Button, Demographic, Interest, etc.)

- Landing page, a web page that the visitor lands on after clicking the CTA button on the ad. The purpose of this page is to convince the reader to exchange their contact information for you lead magnet. Alternatively, you may choose to by-pass collecting the email and deliver the lead magnet right off the bat. You’d do this to build goodwill and it increases the odds that the visitor will see your lead magnet.

- Lead magnet/enticing offer deliverability. Usually sent by email, but not always. You can offer your lead magnet on a web page for your leads to view, or to download

- Follow up drip email/text automated sequence. Best practice is to email daily for 7-10 days after entering your pipeline, then find a good scheduling system for you to remain consistent with your email/text communication to you audience.

Example Of A Financial Advisor Ad Campaign On Facebook

An example of #1 (Facebook Ad) and #2 (Landing Page or Opt-in page) below:

Facebook Ad Example

Landing Page Example

For your ad creation, there’s a plethora of tools you can leverage to make your ads stand out from the rest. Here’s a few that I highly recommend:

- Chat GPT for title, headline and messaging copy ideas and inspiration

- Gencraft for creating vivid and pattern interrupting pictures. Chat GPT can also do this.

- Convertri for landing page software (there’s hundreds of these softwares, any one of them will do the trick).

- Everwebinar and/or Webinarjam (sister companies) for hosting webinar masterclasses as your lead magnet. They also have in-house landing pages you can choose from. It’s an all-in-one tool for anyone that pushes traffic to a webinar. This tool comes highly recommended! I’ve been using it for years.

- Salesforce and Active Campaign as email automation marketing tools for following up with leads via email after they sign-up for your unique valuable offer.

- Calendly has an automated calendar booking system that you can embed directly in your website.

7) Social Media Lead Generation For Financial Advisors

If you got more time than money and/or you’re in it for the long term, consider growing an audience on social media organically (without paid ads, but the option of doing it with paid ads is strategic one).

Your growth on social media should compound overtime. Simply beware that there are many variables that come into play to make that a guarantee.

Strive to get in a consistent flow of producing and posting content on one platform first before jumping on to another to re-purpose your content.

At first, your content might be cringy and tough to watch, but we all start somewhere. Are you able to play a beautiful song on a guitar the first time you pick one up? NO, you can’t!

Same principle applies to creating content for marketing and to building your brand. Practice makes perfect, and it’s honestly better done, than perfect. Don’t over-analyze in the beginning. Simply practice getting into the habit of posting your content without making too many amendments to the first draft.

Analyze the feedback you’re getting from the audience, in addition to your channel’s metrics after you been posting consistently for a couple of weeks, maybe even months.

Social Media Publishing Tools For Advisors

There are tools that enable you to consolidate multiple social media channels in one hub. This facilitates the re-purposing and of your content, and might save you some time on publishing/posting. Careful though, it’s a double-edged sword.

I have not yet come across a tool that’s 100% effective in re-purposing one piece of content across all social media platforms. Since every platform has their respective formats and dimensions for posting, it’s difficult to have a post show up congruently across all platforms.

In my previous experience, published posts on social platforms would sometimes appear funnier/stranger than they normally would. This wasn’t the case when the same content was posted natively in the platform itself, and not via a 3rd party tool.

With that being said, these 3rd party tools are effective for consolidating all the social media communication. The inbox messages and post comments appear normally at the other user’s end, unlike image/video posts.

This could save you some time and make communicating with your followers/subscribers more efficient. Switching from platform to platform to reply to comments/messages could be cumbersome. Furthermore, it could distract you from completing the task at hand.

Social Media Checklist For Financial Advisors

Here’s a checklist to optimize your social media channels for lead generation:

- Complete your bio with your unique voice and value proposition.

- Include your website or a link to your lead magnet in your bio.

- Research and make a list of your top competitors.

- Analyze what they’re doing, and reverse engineer their process (their bio, topics, length of content, number of hashtags, time the post was published, the thumbnail, the hook, etc.)

- Create quality content consistently. Pick a content production output volume and stick to it. The more content the better. Posting content can be compared to getting at-bats in baseball. The more often you’re at the plate, the better odds you have of scoring. The more content you post, the better odds you have of compounding views for your social media channel. Focus on hooks and retention when producing content that’s educational, entertaining and emotional (the 3 E’s).

- Mix the type of content you produce to initially please the platform’s algorithm. Doing this will also allow you to test the reach on this said platform. Determine what type of content resonates best with your audience and double down on it.

- Analyze your data and repeat what works to scale your growth. Don’t be afraid to over-repeat your content. If a video goes viral, try to repeat the same type of content while keeping it fresh. Use the same topic, sound/music, length, thumbnail, etc.

Compliant Friendly Marketing For Financial Advisors

One thing to remember is the constant navigation of the compliance landscape. You must be careful in what you convey in your messaging through your online communication channels.

I highly recommend you consult with your compliance and marketing team on the DOs and DON’Ts of your brand/marketing regulations prior to producing and publishing content. Doing so will avoid any unnecessary legal conflicts that may arise.

All things considered, in my previous experience, compliance can be challenged and change their minds on a gray subject matter if you bring up business opportunities that c-suite executives are not aware of.

Don’t be afraid to push the envelope sort-of-speak, kindly include executive decision makers and be your biggest advocate for change if it makes sense.

There’s a lot of gray area in the online wealth management marketing space, I challenge you to stand out, while also being compliant friendly. If you’re willing to get through some red tape (which most aren’t willing to do), then you have a big advantage over the others in your industry.

It’s still a “blue ocean” in the digital marketing world for professionally accredited individuals in the finance, wealth and investing space.

There’s no shortage of fake gurus and phony money influencers, so there’s a great opportunity for someone like yourself to stand out from the masses if you’re willing to put in the work or invest in getting it done.

If you’re looking to hire a fractional Chief Marketing Officer to fast-track your business growth online, and you’ve enjoyed reading this post, I’d be more than happy to book a time to chat with you and discuss your business goals. You can book directly in my calendar here.

Conclusion

Digital Marketing and Lead Generation for financial advisors is a vast space and there are many ways to go about it. Undoubtedly, there’s never been a better time to grow your brand and business online, so good on you for learning more on the subject.

Strive to automate as much as you can, in order to give you the time necessary to do other tasks that require scaling the business. With many A.I. tools at our disposal these days, there’s plenty of room for automation in your digital marketing ecosystem.

Focus on creating content that you find pleasure in creating (video, podcast, blog), because you’ll be doing it for a very long time. Once you have more funds to invest on your marketing budget, it’s a process that can easily be outsourced or delegated so you can focus on doing what matters, and that’s signing clients.

I would love to hear your feedback if you read this far, please feel free to leave a comment below. Thanks for reading, I greatly appreciate you reading my post and I wish you nothing but the best of luck in your marketing endeavours.

To book a no-obligation consultation with me to discuss your business & digital marketing goals, simply click here to book directly in my calendar.